Status message

Data retrieved successfully.- NEWS

- Press Releases

- Private Equity

- June 2, 2016

Bain Capital Private Equity to sell FTE automotive to Valeo

Media Contacts

- +33140552175 / 2120 / 3718

- press-contact.mailbox@valeo.com

FTI Consulting

- Hans G. Nagl

- +49 89 710 422 115

- hans.nagl@fticonsulting.com

EBERN, GERMANY, June 2, 2016 – Bain Capital Private Equity, one of the world's leading global private investment firms, today announced that it has reached an agreement to sell FTE automotive (“FTE” or “the company”) to Valeo. With the acquisition of FTE, Valeo strengthens its position as clean technology and system solutions provider. The transaction is subject to customary regulatory and anti-trust approvals and is expected to be closed in the fourth quarter of 2016 or the first quarter of 2017.

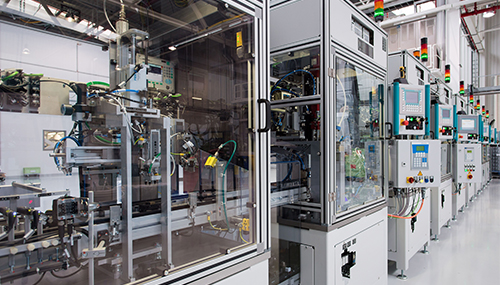

FTE automotive headquartered in Ebern, Germany, develops, manufactures and sells a comprehensive portfolio of tailored and integrated hydraulic and electro-hydraulic systems for cars and commercial vehicles as well as innovative high technology components for various vehicle transmissions.

Since 2013, FTE and funds advised by Bain Capital Private Equity have been working closely together to further develop the company’s success story. FTE strategically focused on accelerating its growth by further broadening the product portfolio to offer innovative high technology components for the various vehicle transmissions. The company won the 2016 PACE Award (premier Automotive Supplier’s Contribution to Excellence) for its lubrication oil pump and the PACE Innovation Partnership Award for its cooperation with a major German OEM.

Michael Siefke, a Managing Director of Bain Capital Private Equity:

“Under Bain Capital Private Equity’s ownership FTE automotive has shown sustainable growth and strong profitability. Its innovative product portfolio, its diversified customer base and the global outreach give FTE automotive a strong position. With Valeo we have found the perfect industrial partner for FTE to enter the next phase and leverage the enormous potential of future markets such as clean technology. We wish FTE and its employees all the best for a successful future together with Valeo.”

Andreas Thumm, CEO of FTE automotive Group:

“We would like to thank Bain Capital for its contribution to our business over the years. Our open and trustful partnership has been a key role in the growth and development of the company. Now we are very much looking forward to working with Valeo as industrial partner. The combination of FTE automotive and Valeo is an excellent fit which offers new future opportunities for our company.”

Rothschild and Goldman Sachs advised Bain Capital on the transaction.

About FTE automotive

The FTE automotive Group, headquartered in Ebern, Germany, is a competent partner in the sector of development and production of drive train and brake system applications for the automotive industry. The company with its 3,700 employees as of end of 2015 is located in all important continents and constitutes one of the leading OE-suppliers for passenger cars and commercial vehicles worldwide. FTE´s sales turnover in 2015 constitutes of more than € 500 million.

About Valeo

Valeo is an automotive supplier, partner to all automakers worldwide. As a technology company, Valeo proposes innovative products and systems that contribute to the reduction of CO2 emissions and to the development of intuitive driving. In 2015, the Group generated sales of €14.5 billion and invested over 10% of its original equipment sales in research and development. Valeo has 134 plants, 17 research centers, 35 development centers and 15 distribution platforms, and employs 82,800 people in 30 countries worldwide. Valeo is listed on the Paris stock exchange and is a member of the CAC 40 index.

About Bain Capital Private Equity

Bain Capital Private Equity (www.baincapitalprivateequity.com) has partnered closely with management teams to provide the strategic resources that build great companies and help them thrive since our founding in 1984. Our team of more than 400 investment professionals creates value for our portfolio companies through our global platform and depth of expertise in key vertical industries including consumer/retail, financial and business services, healthcare, industrials, and technology, media and telecommunications. In addition to private equity, Bain Capital invests across asset classes including credit, public equity and venture capital, and leverages the firm’s shared platform to capture opportunities in strategic areas of focus.